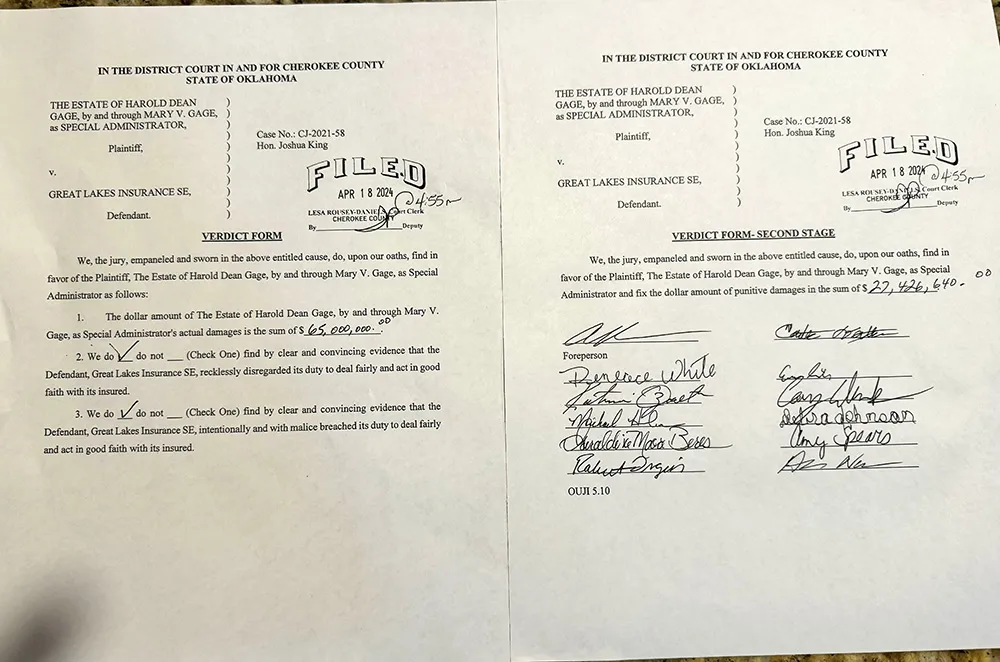

On April 18, 2024, Oklahoma lawyer Rich Toon of Toon Law Firm obtained the largest jury verdict in Oklahoma history in an insurance company bad faith case brought by an individual. The record-setting $92,426,640 jury verdict against Great Lakes Insurance SE for bad faith shatters the previous record. The exhibits shown during the jury trial bring to light the lengths an insurance company may go to not pay a claim. The insurance claim should have been paid before the lawsuit. The insurance company made the decision to not pay $27,426.69 for property damages arising from an apartment fire. The verdict of more than $92M includes $65,000,000 in actual damages and $27,426,640 in punitive damages.

Oklahoma bad faith lawyer Rich Toon with his client and legal assistant on April 18, 2024 at the courthouse after the record-setting $92,426,640.00 jury verdict

In 2023, Tulsa lawyer Rich Toon obtained a jury verdict of $1,484,000 against Protective Insurance Company for insurance company bad faith. That follows a $1,372,289 jury verdict he obtained for his client against State Farm. There are many insurance company bad faith cases in which Oklahoma lawyer Rich Toon has obtained out-of-court settlements for insured people. He also represents small businesses against insurance companies for insurance company bad faith.

On December 12, 2024, we finalized the insurance company bad faith case against Protective Insurance Company. The case involves injuries sustained in a rear-end collision. The insurance company originally refused to pay anything under the insurance policy. Lawyer Rich Toon told the insurance company the injured person would settle for $1,000,000. The insurance company refused and offered $70,000.

The jury’s verdict of $1,484,000.00 is more than 20 times the low-ball offer by the insurance company. After the insurance company appealed the jury’s verdict, the case settled. Our client’s recovery: $1,657,977.57.

Oklahoma’s Unfair Claims Settlement Practices Act

Oklahoma has laws to protect insureds from unfair claims settlement practices by insurance companies. Okla. Stat. tit. 36 § 1250.1 et seq. is Oklahoma’s Unfair Claims Settlement Practices Act. All insurance companies doing business in Oklahoma must promptly investigate the claim, promptly evaluate the claim and promptly pay what the insurance company owes. The failure of an insurance company to do any of those things can give rise to a breach of contract and insurance bad faith lawsuit. An insurance company’s actions can also give rise to a lawsuit involving other theories of recovery against the insurance company.

Contact Oklahoma lawyer Rich Toon at 918.477.7884.