Experience. Knowledge. Confidence.

Call Now 918.477.7884

BLOG

Insurance Company Bad Faith Verdicts in Oklahoma

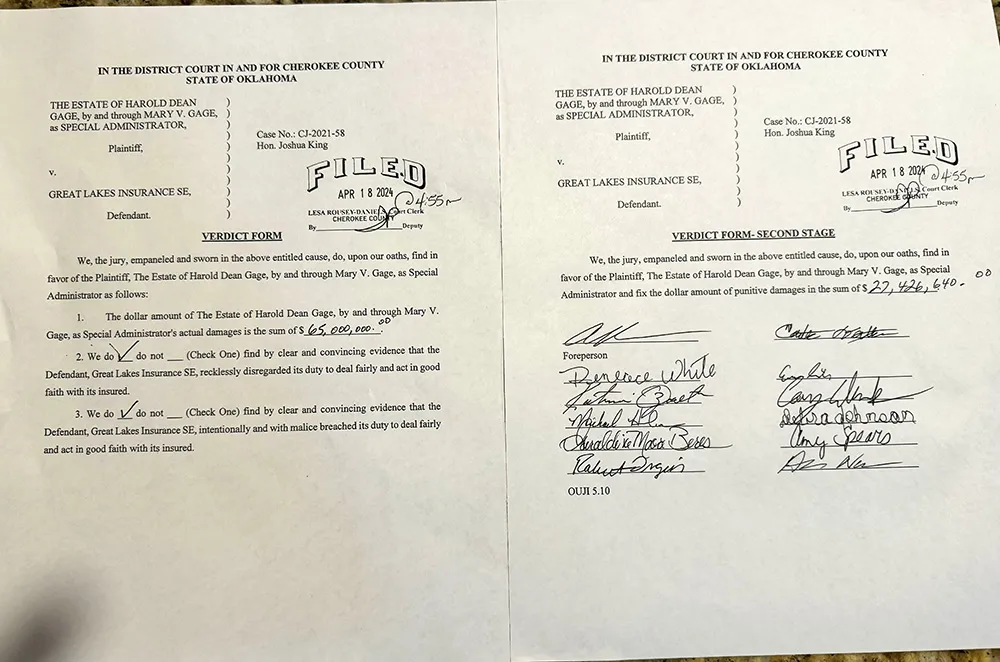

On April 18, 2024, Oklahoma lawyer Rich Toon of Toon Law Firm obtained the largest jury verdict in Oklahoma history in an insurance company bad faith case brought by an individual. The record-setting $92,426,640 jury verdict against Great Lakes Insurance SE for bad faith shatters the previous record. The exhibits shown during the jury trial bring to light the lengths an insurance company may go to not pay a claim. The insurance claim should have been paid before the lawsuit. The insurance company made the decision to not pay $27,426.69 for property damages arising from an apartment fire. The verdict of more than $92M includes $65,000,000 in actual damages and $27,426,640 in punitive damages.

Oklahoma bad faith lawyer Rich Toon with his client and legal assistant on April 18, 2024 at the courthouse after the record-setting $92,426,640.00 jury verdict

In 2023, Tulsa lawyer Rich Toon obtained a jury verdict of $1,484,000 against Protective Insurance Company for insurance company bad faith. That follows a $1,372,289 jury verdict he obtained for his client against State Farm. There are many insurance company bad faith cases in which Oklahoma lawyer Rich Toon has obtained out-of-court settlements for insured people. He also represents small businesses against insurance companies for insurance company bad faith.

On December 12, 2024, we finalized the insurance company bad faith case against Protective Insurance Company. The case involves injuries sustained in a rear-end collision. The insurance company originally refused to pay anything under the insurance policy. Lawyer Rich Toon told the insurance company the injured person would settle for $1,000,000. The insurance company refused and offered $70,000.

The jury’s verdict of $1,484,000.00 is more than 20 times the low-ball offer by the insurance company. After the insurance company appealed the jury’s verdict, the case settled. Our client’s recovery: $1,657,977.57.

Oklahoma’s Unfair Claims Settlement Practices Act

Oklahoma has laws to protect insureds from unfair claims settlement practices by insurance companies. Okla. Stat. tit. 36 § 1250.1 et seq. is Oklahoma’s Unfair Claims Settlement Practices Act. All insurance companies doing business in Oklahoma must promptly investigate the claim, promptly evaluate the claim and promptly pay what the insurance company owes. The failure of an insurance company to do any of those things can give rise to a breach of contract and insurance bad faith lawsuit. An insurance company’s actions can also give rise to a lawsuit involving other theories of recovery against the insurance company.

Contact Oklahoma lawyer Rich Toon at 918.477.7884.

How does the litigation process work?

WHAT CAN A PERSON EXPECT IF THEIR CLAIM IS NOT SETTLED AND A LAWSUIT IS FILED?

Although a lot of work can go on behind the scenes before a lawsuit is filed, sometimes insurance companies and the responsible parties aren’t reasonable. This leaves a client in the position of deciding what to do – settle or file a lawsuit. When dealing with a personal injury claim, the litigation process means the formal legal process of resolving disputes within the court system. If a lawsuit is filed against the responsible parties, what can you expect if you have Toon Law Firm as your lawyers? For starters, you can expect to be kept in the loop throughout the process.

THE USUAL 5 PHASES AFTER A LAWSUIT IS FILED

There are typically five phases to the litigation process: pleadings, discovery, motions, trial, and appeal. In the example of a car wreck, in order to initiate a lawsuit, we will file the Petition in state court or the Complaint in federal court. These are the initial documents wherein we make allegations against the parties involved. Depending upon the nature of the case and strategy, pleadings can range from a few pages to 50 pages or more. You will be referred to as the plaintiff. The people or companies sued by the plaintiff are called the defendants.

SERVING THE DEFENDANTS

Once the initial pleading is filed, we must properly deliver the lawsuit papers to the defendants. This is called obtaining service on the defendants. If we file in state court, then we will have 6 months to obtain service on the defendants pursuant to Okla. Stat. tit. 12, § 2004(I). If we file in federal court, we have 90 days to obtain service on the defendants. Rule 4, Fed. R. Civ. P. (2017). Once service is obtained on the defendants in state court, the defendants have 20 days to file their answer in state court. Okla. Stat. tit. 12, § 2012. If service is obtained on the defendants in federal court, the defendants have 21 days to answer. Rule 12, Fed. R. Civ. P. (2009).

THE DISCOVERY PHASE After the defendants file answers, we move into the discovery phase of litigation. Depending on the case and the number of parties, this phase can vary in the time needed to complete the discovery tasks. In most instances, discovery begins with the parties exchanging written discovery requests called Interrogatories. This is simply a written request to answer written questions. There are also written requests called Requests for Production of Documents. This is simply written requests for a defendant to provide items such as documents, photographs, records, videos, memos, etc. Another written form of discovery is called Requests for Admission. This is simply a written request for a defendant to admit certain facts. The parties that receive the written requests have 30 days to respond. In many cases, defendants object to numerous requests for written answers and documents. In those cases, we file motions to compel with the court. A motion to compel is simply a document we file with the court wherein we request a court order against the other side to properly respond to the discovery requests.

In addition to written discovery requests, we often serve subpoenas on non-parties requesting they produce documents and information. In some cases, we will also send out Freedom of Information Act requests to any governmental agencies that may have relevant documents and information. For example, in car-wreck cases we will usually request the police report, photographs and dashcam video from the investigating agency. In medical malpractice cases, we often contact the appropriate governing boards to obtain files for the defendants, which can include nurses, doctors, and pharmacists.

Once the initial round of written discovery is completed, the next step is usually to take depositions of the parties and any witnesses (sometimes, we take depositions before the initial round of written discovery is completed.) During a deposition, an individual or a representative of a company is placed under oath. While under oath, the person answers questions from the attorneys. Depositions can last anywhere from less than 1 hour to a couple of days. The length of the deposition largely depends upon the witness and the nature of the case. It is not uncommon for depositions to reveal that the defendant has illegally not provided all of the pertinent documents or information. When this happens, we are allowed to file a motion with the court to get an order forcing the defendant to properly respond to our written discovery requests.

MOTIONS FOR SUMMARY JUDGMENT

Once the discovery phase is completed, each of the parties typically file various motions. One kind of common motion is called Motion for Summary Judgment. A motion for summary judgment can be a big part of each case. In the motion, the party provides the court with the evidence they believe proves they are entitled to a ruling in their favor before the case ever goes to trial. Once all motions and responses are filed, the court will often have a hearing where each party can argue the merits of the motion and address questions from the judge. The Court will sometimes make a ruling during the hearing; other times, the ruling from the Court comes after the hearing.

THE PRE-TRIAL CONFERENCE

Depending on what happens with various motions for summary judgment, the next step is usually a pre-trial conference. At the pre-trial conference, the court will be provided with a proposed Pre-Trial Order, where both parties advise the court of the legal issues, the witnesses, and the exhibits. The court usually sets the case for trial at this hearing.

Sometimes, the court provides the parties with a briefing schedule to file motions to exclude various evidence from the trial. These motions are called motions in limine. Each side requests to exclude witnesses, exhibits and anything else the party wants excluded from the trial. While there are common motions in limine that are filed in many cases, each case typically has crucial pieces of evidence that one side wants to be excluded from trial. For example, in a trucking crash lawsuit, if the truck driver has a felony conviction, the lawyer hired by the insurance company may file a motion to keep that evidence from the jury. The usual argument from insurance defense lawyers is that the evidence is more prejudicial than probative.

Before trial, the court will usually hold a hearing to address the motions in limine filed by both sides. The court will simply make its rulings on the briefs filed by the parties without a hearing. Because the rulings on motions in limine can severely impact the way the case is presented to the jury, all parties usually prefer the court’s rulings to occur well in advance of trial. There are occasions when the court provides its rulings on the first day of trial or during trial.

TRIAL

A trial can last anywhere from a day or 2 to more than a month. It depends upon the complexity of the issues. Most civil trials finish in less than a week. The trial begins with voir dire. That is a fancy phrase for jury selection. During jury selection, the lawyers for each party ask potential jurors questions to determine if anyone has a bias that prevents them from being a juror in the case. Once jury selection is complete and a jury is selected, the parties present opening statements to the jury. An opening statement is what the case is about and what evidence is anticipated to be present at trial. As the plaintiff, we have the burden of proof, so we go first.

After opening statements from each side, witnesses are called to testify under oath. Witnesses provide the jury with the facts through their testimony and exhibits. The other side has the opportunity to cross-examine each witness and present exhibits. After we present our witnesses and exhibits, we inform the court that we rest our case. The other side is allowed to then put on its case in chief by presenting its witnesses and exhibits.

Upon completion of the parties’ cases in chief, including rebuttal witnesses, the court hears arguments about jury instructions. Jury instructions contain the applicable law the jury considers in the case. Sometimes, the parties agree on many of the jury instructions to be presented. However, each party usually has additional instructions it believes should be provided to the jury. The court makes the final decision on the set of jury instructions. The next step is when the court reads the jury instructions to the jury.

Then comes closing arguments. In closing arguments, attorneys argue the facts and the law. Like opening statement, we provide our closing argument first. The other side then provides its closing argument. The plaintiff has the final word with the jury by providing a second part of closing argument.

After closing arguments, the jury deliberates. This is when the jury decides who wins. Like everything else in the course of litigation, deliberations vary in how long the jury takes to reach a verdict. Jury deliberations in civil cases often take less than 5 hours to reach a verdict.

This is a broad overview of the litigation process. There is a lot of work that the legal team at Toon Law Firm does behind the scenes. We keep our clients informed along the way. Whether the goal of our client is to go trial, reach a settlement, or be victorious on appeal, our experience runs deep. Contact the lawyers at Toon Law Firm for a free consultation at 918.477.7884.

Hiring an Oklahoma Truck Accident Lawyer

Quickly Hiring an Oklahoma Truck Accident Lawyer

Hiring an Oklahoma truck accident lawyer immediately will protect your rights. The insurance companies will try to gather information to try and avoid responsibility. Insurance company lawyers and investigators will often immediately reach out to the investigating officers and any witnesses. The insurance companies may try to get written statements and affidavits. By quickly hiring a lawyer after a trucking wreck, the injured person’s lawyer can immediately reach out to the investigating officer and any witnesses in order to accurately account for and preserve the memories and records of what happened in the wreck. In addition, the investigating police officer will generate a report. The injured person’s attorney can review the accident report to address any potential issues.

In some instances, a lawyer may request an addendum or supplement to the report to make sure accuracy is preserved. Additionally, the injured person’s attorney can obtain and review the dash-cam footage, body-cam footage, and 911 audio related to the wreck. All of this information will help the lawyer build the case.

The injured person’s attorney can immediately send preservation letters to the trucking company, driver and insurance companies. These letters are also commonly referred to as anti-spoliation letters. Within the letter is notice to preserve all relevant documents, data, audio, and video.

FMCSA

Most trucking companies are governed by the Federal Motor Carrier Safety Administration (“FMCSA”). The FMCSA’s mission is to “reduce crashes, injuries and fatalities involving large trucks and buses.” The FMCSA establishes safety standards and regulations for trucking companies and their drivers, including rules on driver qualifications, hours of service, and vehicle maintenance. In addition, the FMCSA requires trucking companies to retain documentation for specific periods of time.

Driver Qualification Files

Every trucking company must maintain a file for their drivers. This file includes the driver’s application for employment, a medical examiner’s certificate, road test certificate, and an annual motor vehicle record inquiry. These files must be retained for three years from the date the driver’s employment ends.

Hours of Service Records

Truck drivers are limited to the amount of time they can drive a truck during a specific time period. Trucking companies and their drivers must keep accurate and complete records of a driver’s hours of service. These records must be retained for six months from the day they were created.

Vehicle Maintenance Records

Trucking companies must maintain records for all inspections, repairs and maintenance performed on each truck. These records must be retained for one year from the date of the inspection, repair, or maintenance.

Accident Records

Trucking companies must maintain an accident register for all accidents involving its vehicles. The register must include the date and location of the accident, the numberof deaths and injuries, and a brief description of the accident. This register must be retained for three years from the date of the accident.

Drug and Alcohol Testing Records

Trucking companies must maintain records of all drug and alcohol testing performed on its drivers for five years from the date the records were created. Drivers must be tested prior to employment, randomly, and after certain injury producing accidents.

Spoliation

In Oklahoma, spoliation is the “destruction or material alteration of evidence or the failure to preserve property for another’s use in pending or reasonably foreseeable litigation.” Barnett v. Simmons, 2008 OK 100, ¶ 21, 197 P.3d 12, 20. Spoliation includes “intentional or negligent destruction or loss of tangible and relevant evidence which impairs a party’s ability to prove or defend a claim.” Id. “A spoliation sanction is proper where (1) a party has a duty to preserve evidence because it knew, or should have known, that litigation was imminent, and (2) the adverse party was prejudiced by the destruction of the evidence.” Burlington Northern and Santa Fe Ry. Co. v. Grant, 505 F.3d 1013, 1032. The duty to preserve material evidence “‘arises . . . before the litigation when a party reasonably should know that the evidence may be relevant to anticipated litigation.’” Akins v. Ben Milam Heat, Air & Electric, Inc., 2019 OK CIV APP 52 ¶ 34, 451 P.3d 166 (emphasis in original).

In the event a trucking company or driver fails to preserve information, courts can impose various sanctions, including judgments against the trucking company and driver. Adverse inference instructions to the jury can also be given by the court. For example, if a trucking company fails to preserve the alcohol and drug test results for its driver, the court could instruct the jury to assume the driver was under the influence.

Every year over 450,000 large trucks are involved in accidents. More than 100,000 people are injured and almost 5,000 people are killed. Getting a lawyer immediately after an accident helps keep the trucking company, driver and insurance company in check.

An insurance company owes insureds a duty of good faith and fair dealing in Oklahoma.

Under Oklahoma law, an insurance company has a duty to its insureds to handle claims fairly and in good faith. Christian v. American Home Assurance Company, 1977 OK 141, 577 P.2d 899. This duty is extremely important to Oklahomans. Because an insurance policy is a contract, the damages one can obtain under a breach of contract claim are the dollars owed under the insurance policy. In some cases, such as in a property damage case, a party may be able to recover attorney fees. In recognizing the duty of good faith and fair dealing, the Oklahoma Supreme Court confirms that insureds in Oklahoma may obtain tort damages. Tort damages include financial losses, embarrassment and emotional distress tied to the insurance company’s bad faith conduct arising out of the insurance contract.

The Christian case is the seminal case in finding that each insurance contract has an implied duty of good faith and fair dealing. In a nutshell, the insurance company’s conduct in handling an insured’s claim must be reasonable. The reasonableness of an insurer’s actions is always a question for the jury. McCorkle v. Great Atl. Ins., 1981 OK 128, 637 P.2d 583.

The duty of good faith and fair dealing requires insurance companies to act in good faith when handling claims. The duty of good faith and fair dealing also requires insurance companies to give equal consideration to the interests of their policyholders as well as their own interests. The Oklahoma Supreme Court has specifically recognized the duty of good faith and fair dealing does not extend to third parties who are strangers to the insurance contract. Timmons v. Royal Globe Ins. Co., 1982 OK 97, 653 P.2d 907. The most likely scenario occurs when a person hits you and is at fault for a wreck. In Oklahoma, the at-fault party’s insurance carrier does not owe a duty of good faith and fair dealing to a person or entity that is not an insured under the insurance policy.

In Badillo v. Mid Century Ins. Co., the Oklahoma Supreme Court recognizes the insurer is a fiduciary to an insured. 2005 OK 48, 121 P.3d 1080. When dealing with a third party claim against an insured, the insurance company’s “duty of good faith and fair dealing includes the duty to act in a diligent manner in relation to the investigation, negotiation, defense and settlement of claims made against the insured.” Id. at ¶ 36.

The Badillo case includes the Oklahoma Supreme Court stating, “The duty to inform the insured of settlement opportunities is one of the duties subsumed within the duty of good faith owed by an insurer to an insured. Although failure to so inform does not automatically establish breach of the duty of good faith and fair dealing, it is one factor the jury may consider in deciding whether the insurer acted in violation of the duty of good faith and fair dealing.” Id. at ¶ 36

The key components of treating the insured person or insured company fairly are to promptly investigate, promptly evaluate and promptly pay the claims of the insureds. Buzzard v. Farmers Insurance Co., Inc., 1991 OK 127, 824 P.2d 1105. While the definition of what is prompt depends upon the specific facts of each case, the insurance company must be proactive in its investigation and evaluation into the facts of each claim. The insurance company must promptly pay what it owes. The trial lawyers at Toon Law Firm handle many cases against insurance companies where the insurance companies are liable for not promptly investigating, evaluating, and paying. We have recovered millions of dollars against insurance companies for failing to promptly investigate, evaluate and pay what it owed.

Oklahoma’s courts continue to clarify the law regarding insurance company bad faith. In Burch v. Allstate Insurance Co., the Oklahoma Supreme Court holds that Uninsured Motorist Coverage (“UM”) is “first dollar coverage.” 1998 OK 129, 977 P.2d 1027. The purpose of UM coverage is to provide insurance in the event a person causes a wreck and either does not have enough insurance or does not have any insurance. This is coverage afforded to you, the insured, for which you pay premiums. In Burch, the Oklahoma Supreme Court finds that the insurance company must perform an independent investigation into an insured’s claim for UM benefits. The insurance company cannot rely upon the third party’s insurance carrier to determine what the damages total. In other words, the insurance company risks being sued for breach of contract and bad faith for sitting back and being lazy instead of proactively handling the insured’s claim.

Once the UM insurance carrier completes its investigation, it must pay from dollar one. This means that even if the third party has insurance coverage, the UM carrier must pay the value of the claim up to the limits if the third party has not paid. The UM carrier can then seek reimbursement from the at fault party. This is refered to as substituting payment. Many insurance adjusters unfortunately do not understand this concept due to lack of quality training by the insurance company. Sometimes insurance adjusters understand the concept, but literally choose to ignore the insurance company’s obligations under Oklahoma law. Many other states do not require the UM carrier to act until the at fault party pays its limits.

Oklahoma has very strong laws to protect insured people and insured businesses with the steady expansion of policyholder rights and protections. Our state’s courts and legislature provide protection so insurance companies can be held accountable for violating their duty of good faith and fair dealing. Do you have questions about insurance company bad faith in Oklahoma and want answers? Contact the insurance company bad faith lawyers of Toon Law Firm at 918.477.7884 for a free consultation to see how we can help you.