Under Oklahoma law, an insurance company has a duty to its insureds to handle claims fairly and in good faith. Christian v. American Home Assurance Company, 1977 OK 141, 577 P.2d 899. This duty is extremely important to Oklahomans. Because an insurance policy is a contract, the damages one can obtain under a breach of contract claim are the dollars owed under the insurance policy. In some cases, such as in a property damage case, a party may be able to recover attorney fees. In recognizing the duty of good faith and fair dealing, the Oklahoma Supreme Court has confirmed that insureds in Oklahoma may obtain tort damages when an insurance contract is breached. These tort damages include financial losses, embarrassment and emotional distress tied to the insurance company’s bad faith conduct arising out of the insurance contract.

The Christian case is the seminal case in finding that each insurance contract has an implied duty of good faith and fair dealing. In a nutshell, the insurance company’s conduct in handling an insured’s claim must be reasonable. The reasonableness of an insurer’s actions is always a question for the jury. McCorkle v. Great Atl. Ins., 1981 OK 128, 637 P.2d 583.

The duty of good faith and fair dealing requires insurance companies to act in good faith when handling claims. The duty of good faith and fair dealing also requires insurance companies to give equal consideration to the interests of their policyholders as well as their own interests. The Oklahoma Supreme Court has specifically recognized the duty of good faith and fair dealing does not extend to third parties who are strangers to the insurance contract. Timmons v. Royal Globe Ins. Co., 1982 OK 97, 653 P.2d 907. The most likely scenario occurs when a person hits you and is at fault for a wreck. In Oklahoma, the at-fault party’s insurance carrier does not owe a duty of good faith and fair dealing to a person or entity that is not an insured under the insurance policy.

In Badillo v. Mid Century Ins. Co., the Oklahoma Supreme Court recognizes the insurer is a fiduciary to an insured. 2005 OK 48, 121 P.3d 1080. When dealing with a third party claim against an insured, the insurance company’s “duty of good faith and fair dealing includes the duty to act in a diligent manner in relation to the investigation, negotiation, defense and settlement of claims made against the insured.” Id. at ¶ 36.

The Badillo case includes the Oklahoma Supreme Court stating, “The duty to inform the insured of settlement opportunities is one of the duties subsumed within the duty of good faith owed by an insurer to an insured. Although failure to so inform does not automatically establish breach of the duty of good faith and fair dealing, it is one factor the jury may consider in deciding whether the insurer acted in violation of the duty of good faith and fair dealing.” Id. at ¶ 36

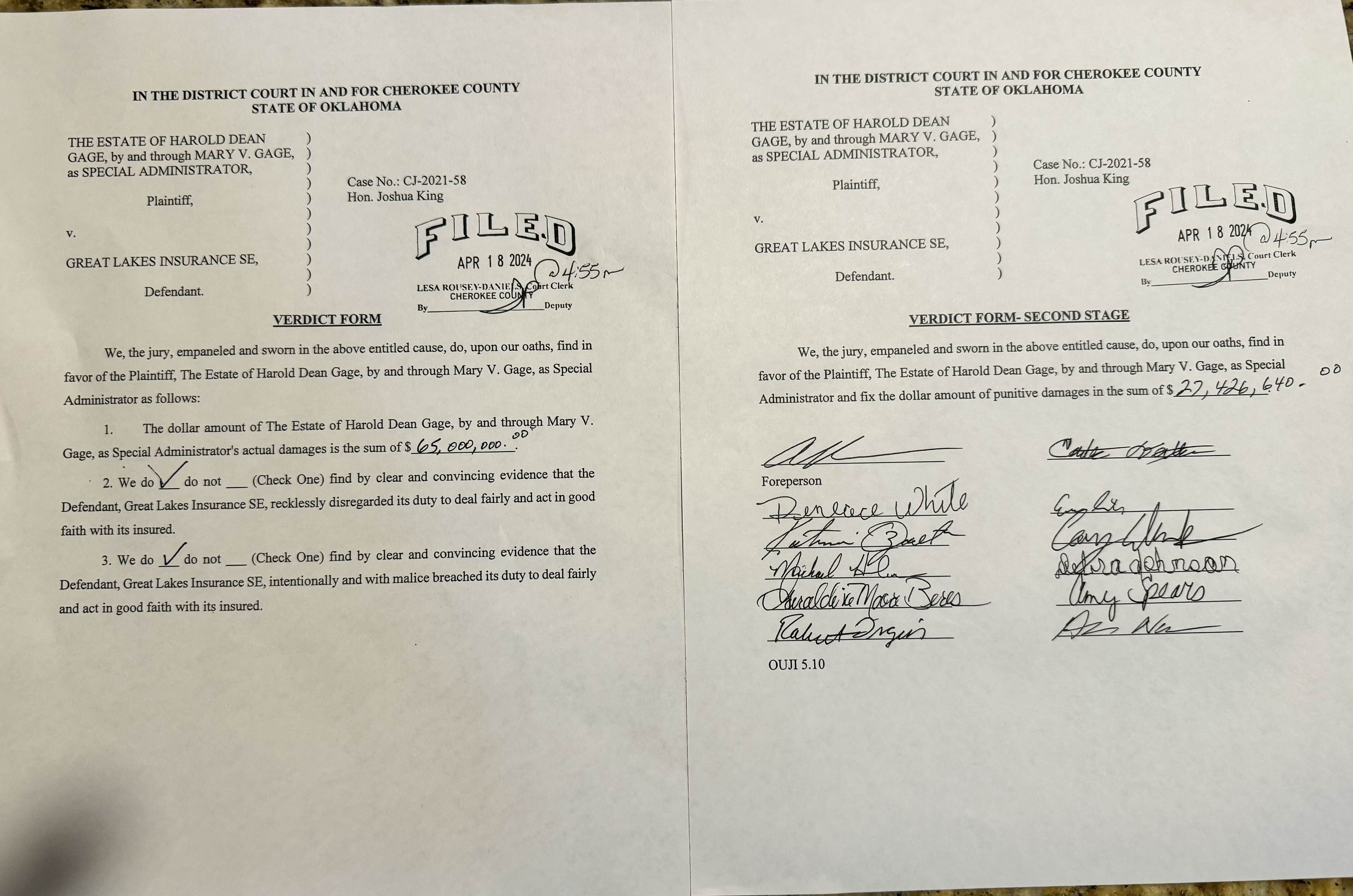

The key components of treating the insured person or insured company fairly are to promptly investigate, promptly evaluate and promptly pay the claims of the insureds. Buzzard v. Farmers Insurance Co., Inc., 1991 OK 127, 824 P.2d 1105. While the definition of what is prompt depends upon the specific facts of each case, the insurance company must be proactive in its investigation and evaluation into the facts of each claim. The insurance company must promptly pay what it owes. The trial lawyers at Toon Law Firm handle many cases against insurance companies where the insurance companies are liable for not promptly investigating, evaluating, and paying. We have recovered millions of dollars against insurance companies for failing to promptly investigate, evaluate and pay what it owed.

In recent years, the Oklahoma courts have continued to clarify and expand the law regarding insurance company bad faith. In Burch v. Allstate Insurance Co., the Oklahoma Supreme Court holds that Uninsured Motorist Coverage (“UM”) is “first dollar coverage.” 1998 OK 129, 977 P.2d 1027. The purpose of UM coverage is to provide insurance in the event a person causes a wreck and either does not have enough insurance or does not have any insurance. This is coverage afforded to you, the insured, for which you pay premiums. In Burch, the Oklahoma Supreme Court finds that the insurance company must perform an independent investigation into an insured’s claim for UM benefits. The insurance company cannot rely upon the third party’s insurance carrier to determine what the damages total. In other words, the insurance company risks being sued for breach of contract and bad faith for sitting back and being lazy instead of proactively handling the insured’s claim.

Once the UM insurance carrier completes its investigation, it must pay from dollar one. This means that even if the third party has insurance coverage, the UM carrier must pay the value of the claim up to the limits if the third party has not paid. The UM carrier can then seek reimbursement from the at fault party. This is refered to as substituting payment. Many insurance adjusters unfortunately do not understand this concept due to lack of quality training by the insurance company. Sometimes insurance adjusters understand the concept, but literally choose to ignore the insurance company’s obligations under Oklahoma law. Many other states do not require the UM carrier to act until the at fault party pays its limits.

Oklahoma has very strong laws to protect insured people and insured businesses with the steady expansion of policyholder rights and protections. Our state’s courts and legislature provide protection so insurance companies can be held accountable for violating their duty of good faith and fair dealing. Do you have questions about insurance company bad faith in Oklahoma and want answers? Contact the insurance company bad faith lawyers of Toon Law Firm at 918.477.7884 for a free consultation to see how we can help you.